Lower interest rates significantly stimulate the real estate market by making home purchases more affordable, increasing demand from first-time and experienced buyers. This surge in demand leads to heightened competition among sellers, potential price increases, and a rise in refinances. Resulting in a positive feedback loop that can balance or heat up the market, influenced by regional factors and economic conditions. Real estate professionals must adapt by understanding shifting dynamics, consumer behavior, and leveraging digital marketing tools to reach a broader audience.

In today’s economic climate, central banks’ rate cuts have significantly impacted the real estate sector. Lower interest rates stimulate housing demand, fueling both buying and selling activities. This article delves into the intricate relationship between reduced borrowing costs and market dynamics, offering insights for real estate professionals navigating this environment. We explore strategies to capitalize on higher demand while providing a comprehensive guide to demystifying the connection between rate cuts and increased homeownership.

How Lower Rates Impact Housing Market Dynamics

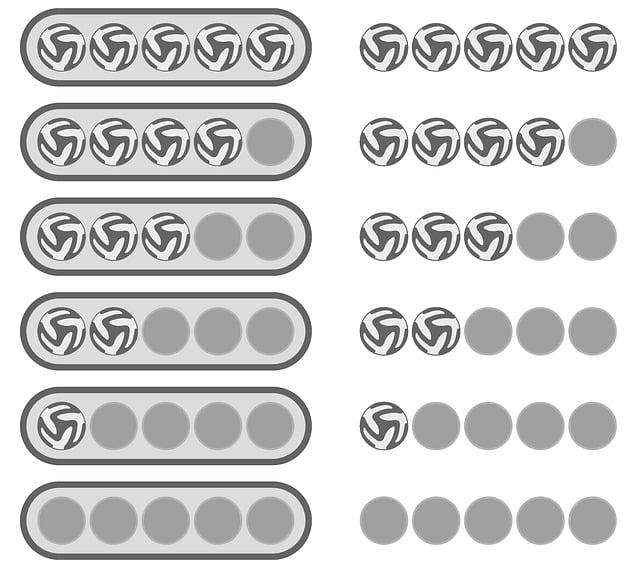

Lower interest rates act as a powerful catalyst in the real estate market, significantly influencing its dynamics. When rates decline, purchasing a home becomes more financially accessible, as the cost of borrowing money for mortgages decreases. This, in turn, stimulates demand among prospective buyers who had previously been deterred by higher lending costs. As a result, the housing market experiences a boost, with increased footfall and heightened interest from both first-time and experienced buyers.

The impact is multifaceted; it encourages more people to enter the real estate sphere, fosters competition among sellers, and can drive up property prices. Lower rates also often lead to a surge in refinances, as existing homeowners look to take advantage of the favorable conditions to secure new loans with better terms, further intensifying market activity. This dynamic creates a positive feedback loop, where rising demand meets limited supply, potentially leading to a balanced or even overheated market, depending on regional factors and economic conditions.

Demystifying the Connection Between Rate Cuts and Homeownership

Lower interest rates have a profound impact on the real estate market, acting as a catalyst for increased housing demand. When central banks cut rates, it makes borrowing money cheaper, which is music to the ears of prospective homeowners. With lower monthly mortgage payments, buying a home becomes more accessible and appealing. This affordability boost often leads to a surge in house hunting and sales.

The connection between rate cuts and higher demand isn’t just about financial savings; it’s also about psychological comfort. Lower rates signal economic stability and growth, encouraging individuals and families to take the leap into homeownership. As a result, real estate markets can experience a revitalized atmosphere, with more active buyers entering the scene and driving up competition for available properties.

Strategies for Real Estate Professionals in a Low-Rate Environment

In an environment where lower interest rates are stimulating housing demand, real estate professionals need to adapt their strategies accordingly. They should first focus on understanding market dynamics and consumer behavior shifts brought about by the low-rate scenario. This includes staying updated on changing buyer preferences and identifying niche markets that may be more responsive to the reduced costs.

For instance, these professionals can leverage digital marketing tools to reach a broader audience. Offering personalized services and showcasing properties through virtual tours can attract cost-conscious buyers who are remotely exploring their housing options. Additionally, real estate agents should emphasize the long-term financial benefits of homeownership, such as building equity, to entice buyers in a low-rate climate.