In real estate, a strong credit score is vital for securing affordable financing due to its influence on interest rates and loan eligibility. Lenders assess creditworthiness, property details, market demand, and economic conditions to determine loan terms. Economic robustness generally leads to favorable borrowing conditions, while downturns may result in tighter standards. Government policies, like interest rate adjustments, also significantly impact real estate financing costs, affecting mortgage affordability and accessibility.

In the dynamic realm of real estate, understanding borrowing costs is paramount for both borrowers and lenders. This article delves into the crucial determinant of these costs: credit scores. We explore two key perspectives: the lender’s assessment of factors influencing loan approval and rates, and the broader market dynamics shaped by economic conditions. By dissecting these elements, we provide insights that shed light on the intricate interplay between creditworthiness, finance, and the real estate market.

Understanding Credit Score: The Key Player in Real Estate Borrowing

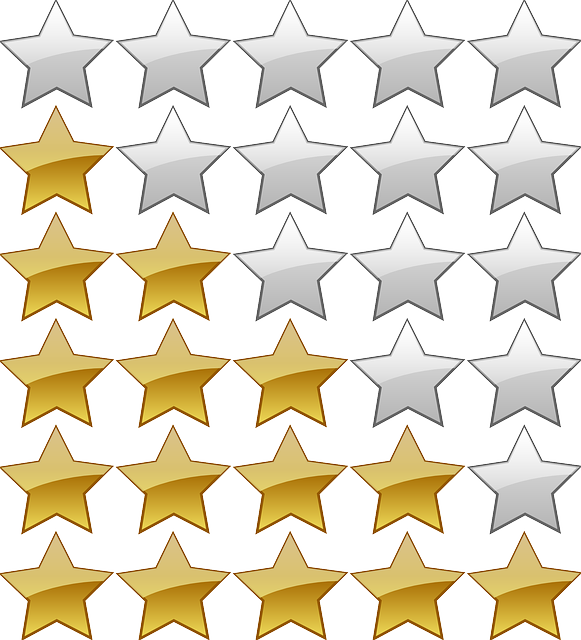

In the realm of real estate, understanding your credit score is paramount as it serves as a crucial determinant of borrowing costs. A credit score is a numerical representation of an individual’s financial reliability and is calculated based on various factors such as payment history, debt levels, length of credit history, types of credit used, and new credit inquiries. For borrowers in the real estate sector, this score plays a pivotal role in securing loans for purchasing properties or refinancing existing mortgages.

Lenders often view a strong credit score as an indication of responsible financial behavior, which translates to lower interest rates and more favorable loan terms. Conversely, a weak credit score may result in higher borrowing costs, stricter lending criteria, or even denial of loan applications. Therefore, maintaining a good credit score is not just beneficial for real estate transactions but also a strategic move to access affordable financing options in the long run.

Lender's Perspective: Factors Affecting Loan Approval and Rates

From a lender’s perspective, several factors play a crucial role in determining loan approval and interest rates for real estate transactions. First and foremost, the borrower’s creditworthiness is a key consideration. Lenders assess a borrower’s financial health through their credit history, income stability, and debt-to-income ratio. A strong credit profile with consistent repayments and minimal debts typically leads to more favorable terms, including lower interest rates.

Additionally, the type of property and its location significantly impact loan decisions. Real estate lenders often have specific criteria for different property types, such as residential, commercial, or land. The value and market demand for a property also matter; lenders may offer better rates for well-collateralized loans secured by high-value assets in areas with robust real estate markets. Other factors like the borrower’s down payment amount, loan purpose, and the lender’s own risk appetite can further influence the approval process and the resulting borrowing costs.

Market Dynamics: How Economic Conditions Impact Real Estate Financing Costs

The real estate market is a dynamic ecosystem where economic conditions play a pivotal role in shaping borrowing costs for prospective homeowners and investors alike. Market dynamics, influenced by various macro-economic factors, can dramatically alter financing options within the real estate sector. For instance, during periods of robust economic growth, strong property values and low unemployment rates typically translate to more favorable borrowing terms. Lenders, confident in the market’s stability, may offer competitive interest rates and flexible loan conditions, making homeownership more accessible.

Conversely, economic downturns or recessions can lead to tighter lending standards as lenders become more risk-averse. Higher default risks associated with uncertain economic times might result in increased borrowing costs for qualified borrowers. Additionally, government policies and central bank interventions, such as interest rate adjustments, significantly impact real estate financing costs. These external factors create a complex interplay that influences the affordability and accessibility of mortgages, shaping the overall landscape of real estate financing.